SUNTEC REIT announced its results on 30 Jul. 2Q09 results were above expectations with a 6.6% YoY increase in 2Q09 DPU to 2.98 cents. Revenue was up 8.9% YoY underpinned by higher rents achieved for Suntec City and Park Mall properties. Suntec City was the main contributor, generating 87% of the Total Gross Revenue for 2Q09. Closing price for Suntec on 30 Jul was $1.1 and Div Yield is 11.8%

Current Situation

Office

Office sector is the major contributor for Suntec REIT however there has been downward pressures on the rental rates for office supply as demand continues to drop. Occupany rate for 1H09 stood at 94.8% as compared to 99.4% for 1H08. Passing rents for Suntec City office average about $6/sq ft, marginally below the spot transaction of $6-7/ sq ft. The managment has stated that this is clearly still a tenant market and the focus on tenants' retention is paramount. I believe that in view of this, the management will focus on optimisation of the occupancy rate at the expense of rental rates and it is unlikely that rental rates will revert to an upward trend anytime soon.

Retail

Retail space occupies 36% of Suntec REIT portfolio but they contribute to 53% of the total revenue of 2Q09. This segment has remained resilient over the economic downturn and is a key support for Suntec REIT performance thus far. Occupancy rate remain at 98.4% for 1H09, not much difference compared to the 98.9% figure in 1H08.

Macro business forecast (2009 - 2011 )

The office sector will remain to be under downward pressures for the foreseeable future due to the completion of new commercial block, increasing the overall supply of lettable office space amidst a declining demand. For Suntec to maintain its edge, it will have to consistently managed the office space through renovation and upgrading the facilities to attract and retain tenants.

The retail sector will be received a huge boost in the coming years given the completion of the two circle line at Esplanade and Promenade together with the launch of the IR at Marina Sands. These projects will strongly enhance the traffic flow at Suntec City and will be a key driver for the retail segment.

Finally, the lack of debt obligation till 2011 will free the management from any worries for the short term.

Strategies for the future

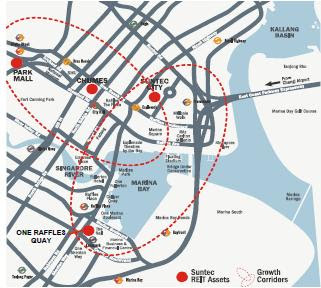

I extracted this diagram from the management presentation. As shown, Suntec REIT key to growth will be to identify possible areas for key development or for acquisitions. This will help to solidify Suntec REIT competitive advantage in this area. However, one key challenge for this will be to balance between acquiring/developing spaces that will encroach on its current portfolio of buildings.

Current Situation

Office

Office sector is the major contributor for Suntec REIT however there has been downward pressures on the rental rates for office supply as demand continues to drop. Occupany rate for 1H09 stood at 94.8% as compared to 99.4% for 1H08. Passing rents for Suntec City office average about $6/sq ft, marginally below the spot transaction of $6-7/ sq ft. The managment has stated that this is clearly still a tenant market and the focus on tenants' retention is paramount. I believe that in view of this, the management will focus on optimisation of the occupancy rate at the expense of rental rates and it is unlikely that rental rates will revert to an upward trend anytime soon.

Retail

Retail space occupies 36% of Suntec REIT portfolio but they contribute to 53% of the total revenue of 2Q09. This segment has remained resilient over the economic downturn and is a key support for Suntec REIT performance thus far. Occupancy rate remain at 98.4% for 1H09, not much difference compared to the 98.9% figure in 1H08.

Macro business forecast (2009 - 2011 )

The office sector will remain to be under downward pressures for the foreseeable future due to the completion of new commercial block, increasing the overall supply of lettable office space amidst a declining demand. For Suntec to maintain its edge, it will have to consistently managed the office space through renovation and upgrading the facilities to attract and retain tenants.

The retail sector will be received a huge boost in the coming years given the completion of the two circle line at Esplanade and Promenade together with the launch of the IR at Marina Sands. These projects will strongly enhance the traffic flow at Suntec City and will be a key driver for the retail segment.

Finally, the lack of debt obligation till 2011 will free the management from any worries for the short term.

Strategies for the future

I extracted this diagram from the management presentation. As shown, Suntec REIT key to growth will be to identify possible areas for key development or for acquisitions. This will help to solidify Suntec REIT competitive advantage in this area. However, one key challenge for this will be to balance between acquiring/developing spaces that will encroach on its current portfolio of buildings.

No comments:

Post a Comment